"Buying opportunities." That's what I'll optimistically call the theme from May. Otherwise, I might be pretty chagrined by my change in net worth. Obviously the condition of markets here and abroad. Every blogger I read as well as almost everybody else is getting dinged by the negativity because it is not sector or stock specific. Folks are just selling out of the market. To me, if you are decades away from retirement, this really is a buying opportunity. I've been investing regularly during the month mainly buying up index funds although I added to my position in Alcoa and re-opened my position in Apple. If the market continues to sell off, I will continue to buy. I've been sitting on a good amount of cash since I've been concerned about deteriorating economic conditions. If you have funds available I recommend dollar-cost-averaging in slowly (but so slowy that the benefit is destroyed by commissions).

The good news for May is that I got a nominal raise AND, it was made retroactive to January 1st. So, I got one sizable paycheck in May, and another that represents the actual raise which amounts to about $5 per day. Yes, you may snicker now. The head honchos basically took the raise everyone was supposed to get and then cut it by 40-50%. Nice. I don't know how these people expect to retain talent doing things this way. In fact, I don't expect them to, but times are tough and finding a new job isn't easy. For me, I'm going no where as long as this job allows me time to work on Project X. We've hit some detours on X, but in the end these detours may be leading us to the gravy train in terms of fully funding our project so I may have some big updates in the next couple of months.

DW's business is stable, but she's definitely still looking to add more clients. A more client-friendly website may help her progress so that's on her to do list for this month.

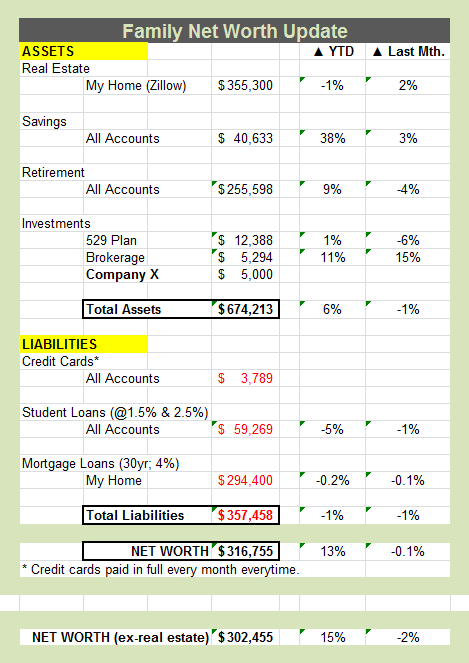

ASSETS

On the asset side, Zillow insists that our home value increased last month. Maybe they know about all the delicious raspberries we got in May? Oh well, for whatever reason, it's up and that's nice. Another thing that's up is the brokerage accounts. I readily admit that the only reason it's up is due to a cash infusion to my son's Sharebuilder account from his grandmother. Savings are also up, but my credit union just sliced its money market rate from 1% down to .75%. Maybe I'll move that money to our Roth's for this year sooner rather than later.

With market conditions as they are, I've been selling weekly put options on stocks where I think the entry point is already pretty solid. Most of the time I'm selling on heavy down days where the stock is close to a 52 week low. Most of these are expiring worthless. Stocks I've been doing this with include NOK, AA, ZNGA, and today I added TPX because it was getting killed. Most of these trades are yielding $100-$300 each. It's not huge dollars and it eats into your buying power, but with the volatility in the markets, I'm happy to be able to leverage my money that is parked in the money market. And, if I happen to get put into these stocks, I'm not really concerned.

LIABILITIES

For liabilities, everything is on track. The slow trudge through all my "good debt" continues. I opened a HELOC this month, but it's not tapped. It's more just there as extra insurance. You never know when you'll need to write a check for $35,000. 🙂

As always, credit cards are still getting paid off every month and variable rate student loans are still getting paid down aggressively.

What about you? How's your net worth shaping up this month? How does that look year over year?

Catch up on all my Net Worth posts here.