In psychology, there is a term called 'cognitive reframing'. It's a term that basically refers to finding different ways to look at the same situation. For example, while many bloggers were bemoaning their net worth dropping last month, I instead reframed it as a buying opportunity. By the looks of things this month, I was right to be reframing it in that way. But, you can certainly use this technique beyond the personal finance arena. I had a good one recently. This past weekend I took my son on a short vacation to the beach. We had done virtually the same trip the year before. It was so successful that in my typical pseuod-autistic way, I decided to replicate it (same restaurants, same hotel, same movie theatre, same beach — with a 6 yr old if it isn't broke, don't fix it). The hotel we stayed at was the Residence Inn. Because it's near the beach, it's expensive, but like last year I was able to use my free night certificate from having a Marriott credit card and paying the $85 annual fee (so free is relative!). Anyway, last year we went mid-week so I could easily get an upgrade to a 2 bedroom suite. He loved having his own room, own bathroom, awesome bed and TV! This time it was a weekend close to July 4, so they were fully booked. There was no chance I would get an upgrade. Instead we would be in a single bedroom suite with a pull out couch in the living area. Knowing the potential for disappointment, the day before we left on our trip I told him he would have a special" Transformer" bed that transforms from a sofa into a bed. He loved it. DW just shakes her head wondering how long I can get away with things like that. Luckily he didn't ask whether it was an Autobot or Decepticon. The point is by re-framing a pullout couch as a Transformer bed, I set the stage for him to have a more positive outlook on the situation.

Before I get into the finances, I want to note that this month will be a little blippy in that I'm doing the post prior to paying my mortgage this month. This is arising because with the last re-finance I set the payment date as late as I could so it pays on the 5th now. After this month, I'll stick to the same posting date so next month we will be back on track.

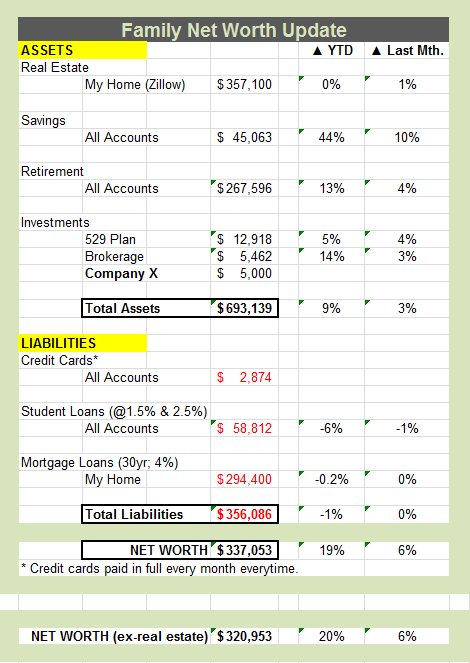

OK, so there is a small mortgage effect in place this month, but it hardly accounts for a 6% rise in net worth. I would love to attribute this to big developments in Project X (my side start-up currently stalled) or DW's business, but neither of those is true. Instead, we have a market recovery from a horrible May, some good option trades, and some healthcare and child care reimbursement. Regardless, I'll take it!

ASSETS

On the asset side, Zillow again insists that our home value increased last month. This basically makes its value flat for the year. That's actually believable given where we live. Our savings is now up 44% year to date. This is excellent. One of my big goals this year was to increase emergency savings and liquid assets. We're certainly on track here. Still, it's important to keep in mind that 22% of that money is allocated to funding our Roth's for the year. I still just haven't transferred it over yet because I've become enamored with the savings account total. Maybe I'll get over it this month and make the transfer.

LIABILITIES

For liabilities, everything is on track. The slow trudge through all my "good debt" continues. I've optimized the interest rates on all this debt the best I can. However, I did tell my mortgage broker this month that I would be willing to re-finance again if I can get it down to a 30 year fixed rate of 3.5%. We'll see how all this plays out over the months ahead. Either way, I'm content with my position.

As always, credit cards are still getting paid off every month and variable rate student loans are still getting paid down aggressively.

What about you? How's your net worth shaping up this month? How does that look year over year?

Catch up on all my Net Worth posts here.