Well, I finished my taxes this past weekend. I still can’t seem to get my withholding right to keep me from getting a large refund. I’ve used the calculator at the IRS, but like most things IRS-related, it’s not exactly intuitive. I know there’s worse things in the world, but I hate, hate, hate giving the US government an interest-free loan. When my refund comes it will be a nice chunk towards funding one of my Roth’s for this year though.

I use TurboTax.com, a sponsor of this website, for my returns. I have for at least the past 5 years. It has made my life much easier. Last year I took my return to a professional as well just as a check, and everything was right with deductions maximized. That was a damn expensive peace of mind I bought (that I wrote off this year!).

One of the interesting figures that TurboTax calculates is your effective tax rate. What’s an effective tax rate? It’s the the actual rate at which you are paying taxes on your total income. Effective tax rate is calculated by taking your total tax paid and dividing by your total taxable income. My effective tax rate over time looks like this

2010 9.95%

2009 9.29%

2008 11.2%

2007 6.79%

2006 9.75%

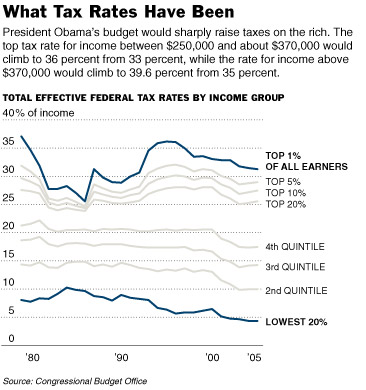

My average effective tax rate over that time is 9.4%. I think this is not bad. There’s not a lot of data out there on effective tax rates, but this report from the IRS on the 400 persons with the highest AGI in the US suggests I’m paying a lower percentage than they are, but not by much and the spread is shrinking. In contrast, the inset graph from the New York Times suggests I’m around the 2nd quintile income group based on my effective tax rate. That’s great! I’m paying taxes at a rate far lower than my actual income!