This represents an update to my review from earlier this year. As a reminder the US Bank Cash+ VISA is one of my core cards. I use it exclusively for paying my cell phone bill and eating at restaurants. The rewards structure used to look like this:

- Earn 5% Cash Back on two categories – YOU CAN CHOOSE! (CAPPED AT $2K IN SPENDING/QTR)

- Earn 2% Cash Back on gas, groceries or drug stores – YOU CHOOSE ONE!

- Earn 1% Cash Back on everything else

- Get a $25 Cash+ Bonus debit card each time you redeem $100 or more Cash Back in a single redemption.

- No Annual Fee

- Earn a .25% or .50% bonus on all purchases by opening a Gold or Platinum checking account at US Bank

Now it looks like this:

- Earn 5% Cash Back on two categories – YOU CAN CHOOSE! (CAPPED AT $2K IN SPENDING/QTR)

- Earn 2% Cash Back on gas, groceries or drug stores – YOU CHOOSE ONE!

- Earn 1% Cash Back on everything else

- Get a $25 Cash+ Bonus debit card each time you redeem $100 or more Cash Back in a single redemption. (ONCE PER YEAR)

- No Annual Fee

Earn a .25% or .50% bonus on all purchases by opening a Gold or Platinum checking account at US Bank

So, for those of who have been benefiting from having bank accounts with US Bank, the party is over. This is really unfortunate because it’s the only reason I was keeping my mortgage with them, and now I see little hope of refinancing below my ridiculously low 4% rate since rates have risen. Oh well. Anyway, at least this means I can retrieve the $25 I put into their savings account and $25.15 in their checking account and close them since these rewards were the only reason I opened them. I’m still keeping the card (for now) as I have no viable alternative. If any of you have better ideas, I’m all ears!

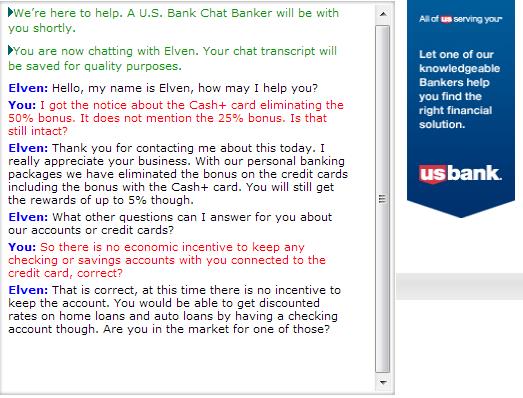

PS Although the letter only mentions .50% bonus, I confirmed that the .25% bonus is also eliminated.