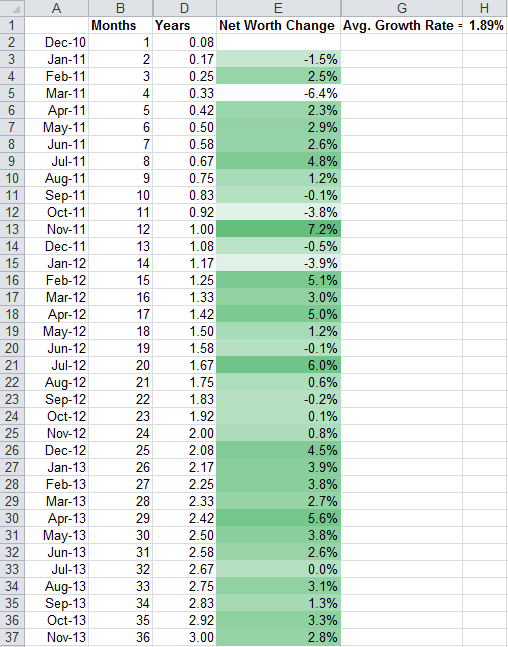

I was having a discussion over on Debt Blag that made me want to take a look at some of the trends in my net worth since I started calculating them. As you can see in the LONG table below, 2013 has been a really good year from a net worth point of view. In fact, looking back 2 years, there’s only 4 negative months. Going back to the beginning there’s only 8 negative months out of 35. I would say that’s not too bad considering the macro environment over the same timeframe. For me the bigger positive is the trend of non-negativity over the past 14 months. Additionally, the size of the monthly increases in percentage terms are remarkable because of course there is an ever-growing base underneath that makes the 2 and 3% gains in 2013 a lot more meaningful than the ones in 2011.

The average growth rate is 1.9%, but that’s not really a useful figure because as I just explained treating every month equally makes no sense given that the underlying base is changing monthly. I actually use a weighted average (weighted more heavily towards recent months) to do a fun little projection of net worth. I like to see how close I can get to the next month’s number (almost never) and to see how long it will take to get our net worth into the 2 comma club (a long time!).

Actually, as time wears on and more of my portfolio is less dominated by the markets and we move further into fixed income my prognostication abilities should increase. However, those days are luckily far away.

For those of you who track net worth, how do you think about these ideas and how have your historical rates looked over the same period?