There are 53,058 books on goal setting at Amazon, and my 2012 goal is to read none of them. It's only day 3, and I'm well on my way to succeeding. My only goal is on every page of this blog, that's one million dollars in net worth. I'm about a quarter of the way there, and if I get there in the next 10 years, I would be amazed. Every other financial decision is made with that goal in mind. Do I pick up this penny lying on the sidewalk? YES! Anyone who disrespects money enough to not pick up their dropped change should be shot. Should I max out my 401k this year? YES! If you can, you should. Whatever you do, make sure you contribute enough to get the company match. Should I take a vacation even though the opportunity costs of doing so will delay my goal a little? HELL YES!! Having a long-term goal is great, but you should not subordinate living the rest of your life well to reach it. Keep that in mind with your New Year's resolutions.

Alright enough of my proselytizing, let's take a look at how 2012 is starting out. For the family, DW's practice is picking up the pace and will easily break even this month. It would be nice to see some more cash paying clients though. She continues to pursue additional marketing paths that will hopefully deliver that kind of clientele. For me, it's work as usual. There's nothing really exciting on the job front, but that could always change quickly. For now, I just continue to be grateful for a good job and a great boss. Also, since the transition, they have changed the way I'm paid from bi-weekly with a two week lag to bi-monthly with no lag. This essentially results in me getting an extra two week paycheck in January as they eliminate the lag. Nice. That will mostly go towards funding the 2011 Roth IRA's which still need over $3k.

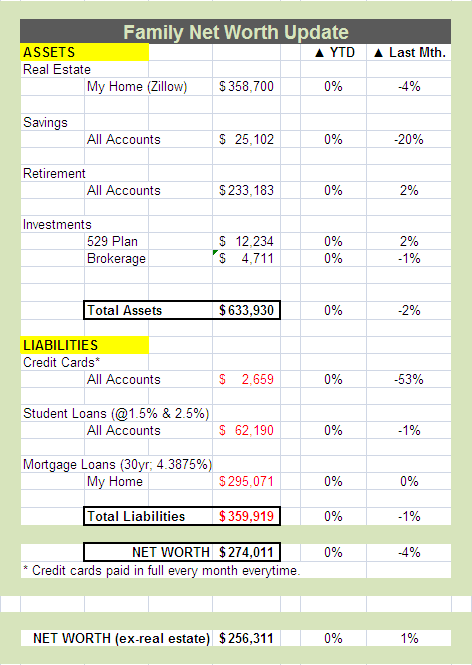

ASSETS

On the asset side, my home value fell (again), but this is still meaningless to me since I'm not planning to sell in the foreseeable future. The value would have to fall another 20% for me to be underwater. For savings, many bills were paid and I made a Roth contribution so there are fewer liquid assets than I would like. DW is also sitting on lots of accounts receivable from Medicaid who has yet to pay her a cent from Oct.-present. Oh, to be the government and only pay bills when you feel like it.

Investment and retirement accounts are relatively flat which is in line with the markets. This will usually be the case since a large portion of my portfolio is tied to the S&P 500.

LIABILITIES

For liabilities, it's the same ol' story. Credit cards are still getting paid off every month, variable rate student loans are still getting paid down aggressively, and 1.08333 mortgage payments are being made. Liabilities reduced by 1% again this month.

What about you? How's your net worth shaping up this month? How does that look year over year?

Catch up on all my Net Worth posts here.