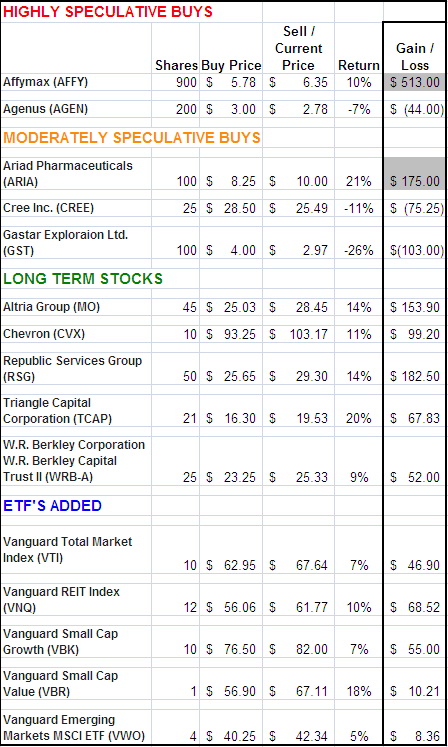

Back in August 2011, I went on a buying spree of sorts when the market was tanking. I had a lot of cash burning a hole in my pocket, and I went $PENDING! I also promised to re-visit that post in 6 months time. Well, here we are 6 months later. During those 6 months, the S&P 500 returned about 2%. Let's take a look at how I performed.

HIGHLY SPECULATIVE BUYS

- Affymax (AFFY) – 900 shares at $5.78 – This was a huge position, and I grew increasingly disturbed because it was underwater for the bulk of the past 6 months. However, back in December there was some good news and a big run-up. I ended up selling for a nice gain. It's trading even higher right now, but I'm happy to be out of it.

- Agenus (AGEN) – 1200 shares at .50 – Agenus has been a big disappointment. Despite recent gains, it's still underwater, and it did a 6:1 reverse split which decreases my ability to sell options if it ever does take off. I can't wait to sell. Hoping for break-even.

MODERATELY SPECULATIVE BUYS

- Ariad Pharmaceuticals (ARIA) – 100 shares at $8.25 – Ariad is the only other stock I've sold. I actually sold a call on these shares so my actual gain is about $60 more than what's reported below. I got called out at $10. The stock is now trading in the 14's. This was meant to be a short-term trade all along, and I'm happy with the result.

- Cree Inc. (CREE) – 25 shares at $28.50 – I got fooled by Cree. I knew it was oversold and felt vindicated when it rose up fast to $35 in late August. I should have locked in my gains and sold. I didn't, and it has trended down ever since.

- Gastar Exploraion Ltd. (GST) – 100 shares at $4.00 – The research on this stock was probably the best of any on the list. I'm still not sure why it's performing this poorly. Since I can't articulate an answer to that it was probably a stupid purchase.

LONG TERM STOCKS

- Altria Group (MO) – 45 shares at $25.03 – I continue to hold Altria. I have no reason to sell. High dividend and stable pricing makes this feel like a safe stock to me.

- Chevron (CVX) – 10 shares at $93.25 – Chevron continues to be one of the best of breed in energy stocks with a dividend yield of 3.35% for me at this price.

- Republic Services Group (RSG) – 50 shares at $25.65 – As I mentioned in my earlier post, this is a largely range-bound stock. It still is, and I'm quite happy with my 3.43% dividend yield at this price.

- Triangle Capital Corporation (TCAP) – 21 shares at $16.30 – Triangle Capital Corporation, like my other conservative choices, has performed just fine during the period.

- W.R. Berkley Corporation W.R. Berkley Capital Trust II (WRB-A) – 25 shares at $23.25 – Really, you can't find a better chart than this one to illustrate the opportunities in panic selling of conservative investments.

ETF'S ADDED – All of the ETF's I bought are up. They are all just sitting in my Roth IRA slowly growing through dividend reinvestment, and all of these trade commission free at Ameritrade!

STOCKS I WISH I HAD BOUGHT

- LDK Solar (LDK) – I said this was a steal under $5. It still is. Glad I avoided this debacle.

- Lululemon Athletica (LULU) – Lululemon has not been the juggernaut I expected, but I still would have been up 25% had I bought it at $50.

Here's a table of my overall performance. It actually looks pretty good. In spite of the paper losses, the overall return for this selection of purchases clearly outperformed the S&P 500 over the same period (8.5% vs. 2%). If I had to draw a single conclusion from this, it would be to focus on buying really good companies during panic selling periods. Every single one of the long term stocks I picked have turned out to be good investments while the more speculative plays generated nice returns in some instances (with lots of $ at risk) while others are still languishing and tying up my dollars that could be working for me in better positions.

I know this is a super long post. If you read this far, thank you. I'd love to hear your comments.