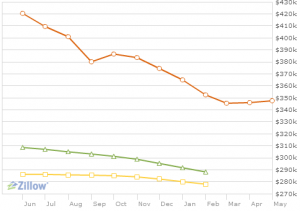

I’ve been posting my net worth for about 6 months now. In that time, I’ve seen a lot of fluctuation that seemed inconsistent with my savings goals. Either something was out of whack with my expenses or something weird was going on. The answer became fairly obvious when I looked at the trends, particularly the trend in the valuation of my home on Zillow. Their “Zestimate”.

Basically, for the past year my home has been declining in value. This actually doesn’t worry me at all since it still hasn’t even fallen to the price I paid for it 2.5 years ago. I’m also unconcerned since I don’t plan on selling it in the next decade or so given that my family and I love where I live. The part that peeves me though is that this Zillow valuation decline basically negates gains in all other areas when I’m calculating my net worth. Would I be as upset if the valuation was artificially boosting my net worth. Maybe, but honestly probably not. I would probably be marveling at my paper gains just like so many others did a few short years ago. But, that’s not the case. The reality is that my home is a very large variable in the calculation of my net worth (over 50%) so any movement in its value causes meaningful shifts in my net worth that really have nothing to do with the day to day effects of my investment and saving decisions. Thus, I wanted to see what my net worth would look like if I took the Zillow home valuation fluctuation out of the picture.

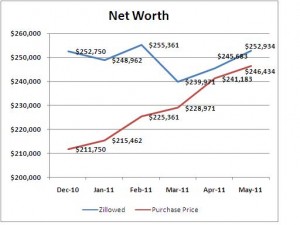

To do that, I re-visited my net worth Excel sheets and created a new net worth figure that removed the Zillow value of my home and replaced it with the actual price I paid. This seemed like a fair number to choose since the current valuation is pretty close to that price. You can see the results.  Basically, if we remove the Zillow effect from the equation, you can see that the artificial benefit of that valuation resets my net worth much lower, but it also shows the reality of my investment returns, savings gains, and debt reductions over the last few months in a far more meaningful manner. Now that’s a trendline I can get behind!

Basically, if we remove the Zillow effect from the equation, you can see that the artificial benefit of that valuation resets my net worth much lower, but it also shows the reality of my investment returns, savings gains, and debt reductions over the last few months in a far more meaningful manner. Now that’s a trendline I can get behind!