The theme for October is definitely: "Give Me Some Booty"

My pirate son scored last night by generating well over 50 pieces of booty from the Pleasantville suburb down the road. Any activity that gets a 5 year old to repeatedly work on learning to add and subtract is good by me. Plus, I get to eat all the chewy stuff that's bad for his teeth!

My wife brought home some booty this month too! She saw her first 2 clients in her brand new office. Woohoo! The return to dual income is so delicious. Hopefully, she can see at least 5 patients this coming month. That would cover the rent and probably wipe away a lot of her worry. She's working diligently to expand her referral base so this seems to be an achievable target.

Sadly, the only additional booty I brought home this month consisted of a few stray coins I found on the ground and about $12 from Google ads. Even worse, my favorite credit card, the Schwab Invest First VISA is officially dead as of Oct. 31. It was a major downer to place it reverently in Drawer of Forgotten Credit Cards.

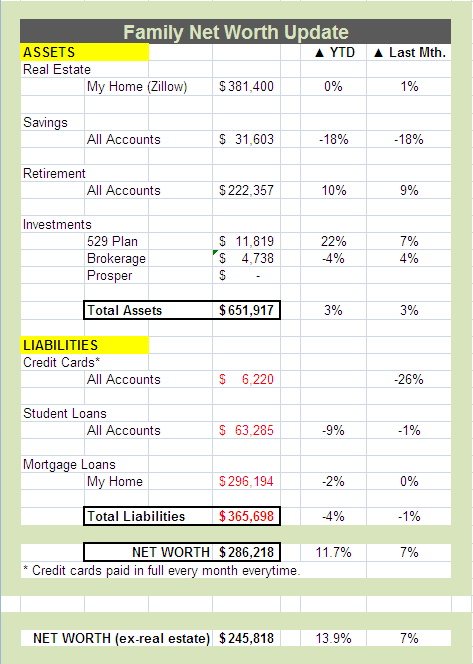

Happily though, I don't rely on blog income to stay alive. On the real job front, my position post-merger looks to be incredibly secure, and there's even a possibility I could see a retention bonus down the road. I'm not counting on it, but it's nice to dream. Additionally, the markets were very good to us in October (one of the best October's on record) so much of the decline in net worth over the past couple of months was erased by one very good month. Let's take a look at the numbers.

On the asset side, savings continues to fluctuate between $30k and $40k it seems. No matter how hard I try, the liquidity level is not stabilizing to the degree I need it to. This month's decrease can be attributed to the investment in supplies and furniture for my wife's business in addition to a Roth contribution. So, the money going out is going into good things which is always important to keep in mind. Still it's nagging me that I can't seem to get over that $40k hump. The good news is that assets are still up 3% year to date.

On the liabilities side, the story is the same as always. Credit cards are still getting paid off every month, variable rate student loans are still getting paid down aggressively, and 1.08333 mortgage payments are being made. Add it all up and liabilities have fallen 4% this year. Happy, happy, joy, joy.

What about you? How's your net worth shaping up this month? How does that look year over year?

Catch up on all my Net Worth posts here.