February has been an extremely busy and exciting month. The BIG thing that happened from a personal finance perspective is that we refinanced our mortgage again down to a new fixed rate of 4%. You can read all the gory details here. As I discussed in that post, this has opened up a question with regards to how quickly we should want to pay down this debt. I am considering making 1 1/6 payments per month. This would mean I'm making 14 monthly payments per year vs. the 13 months per year I was paying. And, it would only increase my payment by $10/mth thanks to the new rate. However, once you take into account the tax adjusted rate for the mortgage, it's below 3%. I anticipate lots of opportunity in the years to come where I could outperform that rate of return on a mortgage overpayment. For now, it's just a nice problem to have.

ASSETS

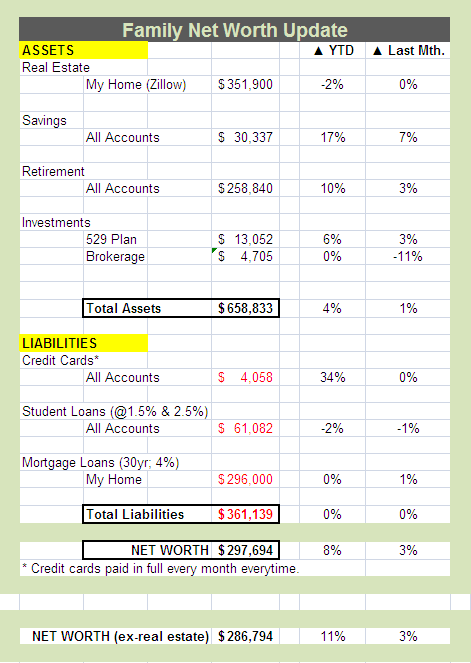

On the asset side, I made a horrible bet in my "play" trading account on Chelsea Therapeutics to get approval for Northera and lots of bad news has crushed my call option position in spite of what is now a likely approval. Ugh. I hate it when I get these wrong. Mostly I hate the folks at FDA who send mixed messages. So that's why there's a 11% dip in my brokerage account. I'll end up spending the rest of the year trying to offset these losses. Blech!

Luckily my passive portfolios are doing just great. A monthly rise of 3% in the 529 plan and retirement accounts is excellent. And, savings is growing too! We can partially attribute that to my DW's business growth which is all captured in the savings area. This is all good news.

LIABILITIES

For liabilities, there's finally a new story to tell thanks to the refinance. A mortgage payment was pulled this month by US Bank, but that was an error since the mortgage was paid off so I'll be getting a check for about $1600 and the way our refinance worked out, we'll be getting another check for about $850. My guess is this will all end up in the Roth accounts. The new loan is only about $1500 more than the old loan which is fine with me since the rate is so dirt cheap. With all that said, liabilities are a little thrown off this month so I just put the new loan amount in as a placeholder. Check back next month to see if I decide to overpay on the new mortgage (I know you'll be on the edge of your seat!).

As always, credit cards are still getting paid off every month and variable rate student loans are still getting paid down aggressively.

What about you? How's your net worth shaping up this month? How does that look year over year?

Catch up on all my Net Worth posts here.