Getting back to my net worth, the only real changes appear on the asset side, and aside from the home valuation, they’re all positive this month. I like that a lot. I’ve removed the Prosper change percentages since they’re misleading because I want them to go down. I’m slowly emptying that account into my savings. My current portfolio of 3 loans are all current and due to be paid off by mid-summer. In terms of liabilities, I continue to pay the mortgage and student loans down at a slightly accelerated rate. Credit cards are paid in full every month and carry an unpredictable amount of business expenses so I removed those non-useful percentages as well.

The only net worth change I anticipate between now and next month is my tax refund which will serve as a 1 time gain that will be used to complete the funding of the 2010 Roth’s a little later than I’d hoped and to add to savings.

Net Worth March 2011

| ASSETS | This Year | vs. Last Month | ||

|---|---|---|---|---|

| Real Estate | ||||

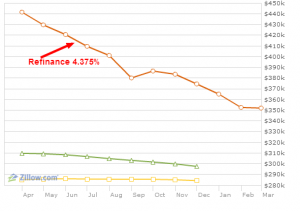

| My Home (Zillow) | $352,000 | -9% | -5% | |

| Savings | ||||

| All Accounts | $24,861 | -50% | 5% | |

| Retirement | ||||

| All Accounts | $220,651 | 9% | 1% | |

| Investments | ||||

| 529 Plan | $12,092 | 24% | 1% | |

| Brokerage | $5,203 | 5% | 7% | |

| Prosper | $168 | |||

| Total Assets | $614,974 | -3% | -3% | |

| LIABILITIES | ||||

| Credit Cards* | ||||

| All Accounts | $6,740 | |||

| Student Loans | ||||

| All Accounts | $67,656 | -2% | -1% | |

| Mortgage Loans | ||||

| My Home | $300,607 | -1% | 0% | |

| Total Liabilities | $375,003 | -2% | 0% | |

| NET WORTH | $239,971 | -5.3% | -6% |