Q1 2012 has been a solid start to the year. For March, the most interesting thing that's been going on is the start-up of a new side project. I'm not going to go into detail now since it's still in its infancy, but starting an LLC and writing a business plan is actually a pretty cool process. Hopefully, I'll have much more to say on this in the weeks and months to come.

From a personal finance perspective, we finally finished our taxes this month. As an aside, if you haven't already done your taxes, I definitely recommend TurboTax. It's been a great package for us. We submitted and got our refund within about 2 weeks. Back to the taxes. As most of you know, 2011 was a rough year for many, my family included. The losses we took starting DW's business left us in position to reap a larger than normal refund from the IRS. This will be nice to add to the liquidity cushion I've been trying to build. Our effective tax rate this year was 9.46% which is completely in line with prior years. As long as I can keep it under 10%, I'm comfortable.

Also in March, DW's business began to stabilize, and she's currently looking to add more clients. Every month this year has been profitable so we're in great shape there, and her profits also add to the liquidity gains.

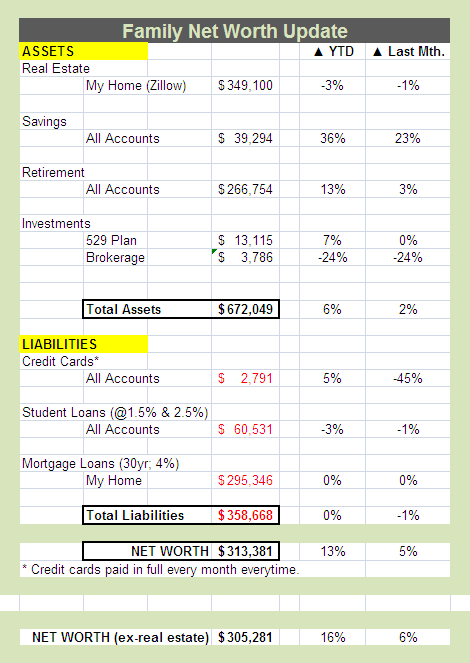

ASSETS

On the asset side, the tax refund and DW's business profits have increased our liquidity nicely in the savings section. Roth's have now been fully funded for 2011 so now we can start worrying about finding $10k for 2012. Retirement accounts continue to have traction. Actually, everything looks good here except for the brokerage account which got hit by my bad bet on CHTP that I discussed last month. CHTP probably won't recover until Northera gets approved in 2013 so I'm expecting to sit in the doldrums for a bit. Like I said last month…BLECH!

LIABILITIES

For liabilities, everything is on track. The student loans should drop below $60k soon which will be nice to see on paper. The new mortgage is working out. April is the first month that we will have a payment, and I'm actually transferring the extra payment I made to the old mortgage so it's already accounted for. Regarding whether to pay off the mortgage more aggressively, for now, I'm not. I'm going to take the liquidity. It's important for the Roth contributions and for the new opportunity I alluded to earlier

As always, credit cards are still getting paid off every month and variable rate student loans are still getting paid down aggressively.

What about you? How's your net worth shaping up this month? How does that look year over year?

Catch up on all my Net Worth posts here.