Happy anniversary. Today your ShareBuilder.com account is roughly 1 year old, and in a few days you will be 5 years old. We're just getting started on your path to financial freedom. I can't wait for the day when you and I can sit down and talk about this together (i.e. bore you to death), but for now, this post will have to do.

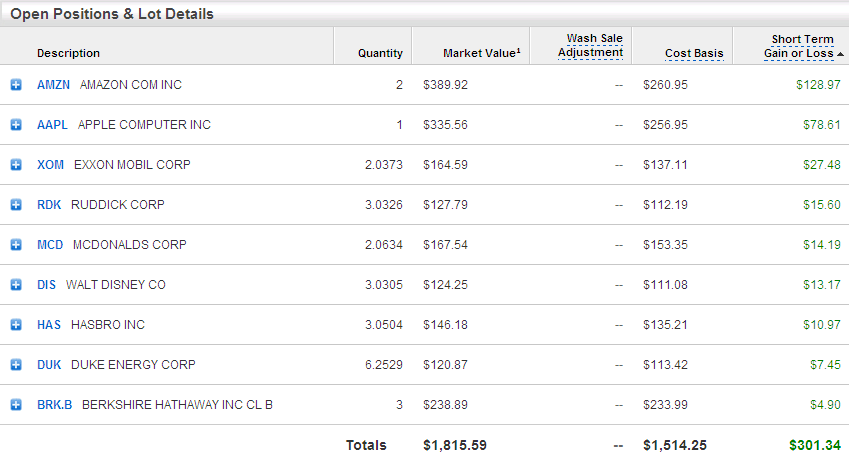

Last year at this time, I opened your brokerage account. As you can see, your portfolio has done pretty well in the past year. Your return of ~20% has outpaced the DJIA, S&P 500, and Nasdaq Composite over the same time period, and you've more than covered the ~$90 in commissions that we paid to buy these stocks (always important to remember your true cost basis). In this year you have weathered the tail end of a recession, strife in the Middle East, and the most powerful earthquake that Japan has ever experienced. All of these macroeconomic events have had meaningful impacts on our economy and the stock market. Within your portfolio, you've witnessed Steve Jobs taking an extended absence from Apple (AAPL) as a result of his cancer. Yet Apple is easily one of your best performing stocks. Great leaders find a way to empower their fellow employees and make themselves obsolete to the ongoing success of their company. Although their presence is always an asset, the company is strong with or without them. This is a great lesson in management.

Within your portfolio, you've witnessed Steve Jobs taking an extended absence from Apple (AAPL) as a result of his cancer. Yet Apple is easily one of your best performing stocks. Great leaders find a way to empower their fellow employees and make themselves obsolete to the ongoing success of their company. Although their presence is always an asset, the company is strong with or without them. This is a great lesson in management.

The top performer in your portfolio is Amazon.com. The upside for AMZN still looks good to me, aside from the lawsuits from the states to collect sales taxes that they currently avoid paying so the savings is passed on to the consumer. The worst performer is Berkshire Hathaway (grandma's choice) which has a bit of scandalous news lately involving David Sokol on some insider trading, but BRK.B is a long-term investment and should be fine. Time will tell.

The only changes to the portfolio are fractional share increases as a result of dividend reinvestment. I recently made the change to stop these purchases. Dividend reinvestment can make understanding your cost basis difficult and doing so with multiple stocks over the next 15 years would just be cruel. Although I hear that this year brokers are responsible for giving you your cost basis which is a much-needed change. Regardless, I'd like to have a portion of the portfolio in cash to take advantage of market opportunities. Also, I really wish I'd bought an index fund ETF like SPY for you. If we keep saving the dividends, we'll be able to buy one…one day. Thus, no more dividend reinvestment.

Within your own life I would argue your personal gains are far outpacing your portfolio. You can count to 20 and know your ABC's. You're starting to sing Lady Gaga songs (although you prefer rock and roll) and your creativity with LEGOS is growing by leaps and bounds. I treasure our time working in the garden, building projects, and exploring the woods and creek nearby. You're an awesome little dude.

Love,

Papa