Anecdotal reports are flowing in on FatWallet and other blogs that this is the Final Countdown to the end of the Charles Schwab Invest First 2% VISA Credit Card (with 0% foreign transaction fees). I'm still hoping the rumors are false or only for select customers. We should know soon since letters were supposed to be sent out shortly.

Anecdotal reports are flowing in on FatWallet and other blogs that this is the Final Countdown to the end of the Charles Schwab Invest First 2% VISA Credit Card (with 0% foreign transaction fees). I'm still hoping the rumors are false or only for select customers. We should know soon since letters were supposed to be sent out shortly.

If this is true and this is the beginning of the end, it's a very sad day for me. I've loved this card for a long time. It's served as my primary card for all puchases (except gas PenFed 5% and groceries AMEX 6%) since April 2009.

UPDATE:

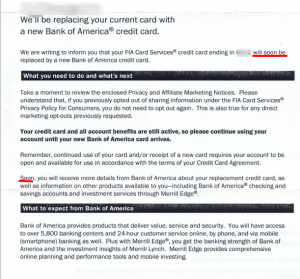

Here's the text of the letter I received from Bank of America dated August 22, 2011. The only hopeful news is there is no clear end date posted. *****New letter received 9/14 puts my drop dead date at October 31st. SIGH****

I've reaped about $1,500 in rewards thanks to this card alone. All of that money went into a Schwab brokerage account where I bought Schwab-branded ETF's commission-free. It's been a great run, and I may just leave the money there to see how just how large my FREE nest egg can grow.

So, what do you do if this has been your primary card too or you're in the market for a 2% cashback card. The reports suggest reps will try to get you to convert to a Bank of America card with the potential to get 1.5%. I don't see myself taking that offer in my lifetime simply because it's B of A, let alone the drop in cash back. The good news is that a roughly equivalent card exists. Just head right over to Fidelity and pick up the Fidelity Retirement Rewards American Express Card. It's very similar to the Schwab card, but it does charge foreign transaction fees unfortunately. Read my review.

Another option is a VISA Signature card from Sallie Mae which also pays 2%. You can read that review here.

Links from FatWallet showing the new HORRIBLE Bank of America offers to replace the Schwab card: