As I looked back over all the net worth posts of 2011, I have to acknowledge that it was a rough year. There's just no getting around it. A lot of things went wrong for my family that impacted us financially. Most of those were beyond our control. I wrote a nice post a while back (that no one really read) about Known, Knowable, and Unknowable Risk, and the same theme applies here to things that are beyond one's control. These events were largely unknowable, and they are going to happen from time to time. The important thing is to build a large enough financial buffer to insulate your family from the brunt of the impact. That's what an Emergency Savings account is there to do. I am thankful for all of the savings we have done during better days that helped to carry us through this year's major events:

- DW's illness, week-long hospitalization and ongoing treatment- Impact: HUGE (emotionally and financially)

- Employers failure to pass HCP tests resulting in ~$4k kicked back to me from 2010 contributions – Impact: Blessing in disguise because the liquidity helped, but the lost retirement funding is painful

- Employer gives crappy bonus to make company look better in hopes of sale – Impact: Great inspiration to get my resume up-to-date and look for other options

- Employer's decision to withhold raises from anyone receiving a crappy bonus again to make the company look better financially in a sale – Impact: Even more inspiration to consider other options.

- Stupid decision to buy a call option on Google right before an earthquake and tsunami – Impact: -$1421.49

- Start up costs for wife's business – Impact: ~-$3,000 but well worth the investment in the long run I predict.

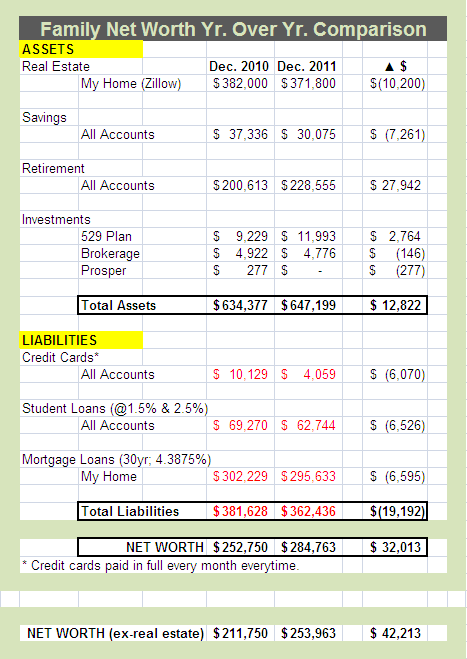

Given all of these events and the macroeconomic conditions in the US and abroad, I had pretty low expectations regarding our change in net worth over the year. Let's check out the numbers:

I was pleasantly surprised when I saw our assets had actually increased over the course of the year. This effect is even stronger if you ignore the real estate component. A very nice surprise indeed that speaks to the value of diligently saving for retirement in automatic accounts like a 401k. On the liabilities side, I knew that the numbers would be looking good. Although the rates on my student loans are low (and lower than my mortgage), I'm actually more excited about taking them down almost 10% this year. At that rate I could be student loan debt free by the end of the decade. Overall, my family's net worth grew more than 12% in year that was filled with turmoil both at home and abroad. That feels pretty good. And, I have to say that if I had not taken the time to look at all the numbers, I would be leaving 2011 feeling like I did a lot worse this year than was the reality. Please take the time to run your own numbers. Maybe you'll end up feeling the same way.