Stocks For Your Kids Series:

- How to Choose

- Year 1 Update

- Year 2 Update

- Year 3 Update

Dear Son,

It’s time to look at your stocks again! These are interesting times at our house as you turned 8. Due to my recent job loss there is probably more uncertainty and stress than you have become accustomed to in your short and relatively blessed existence. In the short term, I’m sure it’s not easy, but in the long term I have come to appreciate times of hardship as opportunities for growth – many times in ways that surprised me. Right now I’m astonished at all of the colleagues and friends who have stepped up in meaningful ways to help me find my next position. I think it’s an excellent lesson in treating people with kindness and respect when there’s really nothing in it for you. That genuineness translates into friendships and relationships that really serve as a bulwark in harder times. It turns out that we are not only prepared financially to endure this hardship, but we are also surrounded by a community that supports our well-being in so many other meaningful ways.

In terms of your personal growth, I am most proud of the voracious reader you’ve become. Last year, reading was a struggle, and now it is a joy to have to come in your room well past bedtime to get you to put your latest adventure down and get some rest. I credit your new Montessori school and one of your peers for stimulating this new passion, but ultimately it is you who continues to cultivate this love. And, I’m starting to get a little scared at how good you are at martial arts!

Our economy continues to slowly recover, but I am optimistic that I will find employment. It certainly feels better to be unemployed right now than it would have if this were 1 or 2 years ago. Let’s hope so.

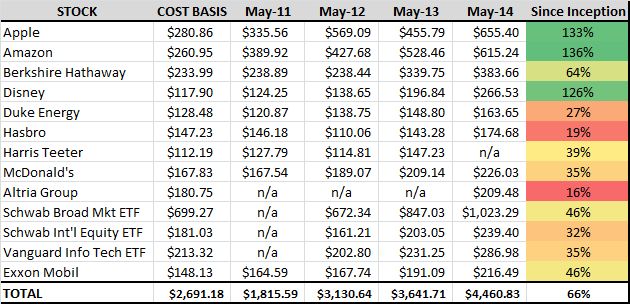

As with our family, there has been some change in your portfolio. Most notably, Harris Teeter was bought out by Kroger last year, and the transaction went through at the end of January. This left you with a final return of about 40% on that investment. Not bad! I used the funds from this buyout and the small amount of remaining cash in your account to purchase 5 shares in one of my favorite dividend stocks, Altria Group. Is it wrong to have bought you shares in a stock that promotes habits that lead to major negative health consequences? Perhaps, but now you and I have voting rights in terms of how direct the future of the company and can have meaningful conversations about corporate ethics with an excellent real world example. In addition, you’ll reap the associated dividend gains which are non-trivial. Currently, you’re up 16% in 4 months since the purchase.

There have been no other in-flows or out-flow to speak of. The overall theme has been one of expanded growth, especially in your technology exposure areas (AAPL, AMZN, & VGT). Every stock is in double digit positive returns. All in all you were up 16% from 2012-13 and now another 22% this past year. Looking at the cost basis in aggregate, you’re up 66% since we started. The market recovery has certainly outpaced the overall economic recovery which of course means that those of us within a certain SES are benefiting far more than others with fewer opportunities.

NOTE: Altria group cost basis is not included in the total since it is a re-investment.